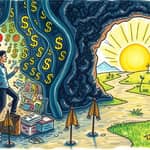

The financial world stands on the brink of a revolution, not of replacement, but of profound partnership.

AI as an augmentation partner is transforming how we manage money, make decisions, and build trust in an increasingly digital age.

This shift marks a move from isolated tools to integrated systems that enhance human judgment, creating a synergy where both intelligence and intuition thrive together.

Imagine a future where your financial advisor is always one step ahead, powered by insights that blend data with empathy.

In today's financial services, AI is no longer just a tool for automation but a collaborative force that amplifies human capabilities.

According to industry surveys, 86% of financial services AI adopters recognize AI's critical role in driving business success over the next two years.

This model focuses on augmenting rather than replacing, with AI handling routine tasks while humans tackle complex decision-making and relationship management.

Frontier Firms, those leading this integration, report returns on AI investments that are roughly three times higher than slower adopters.

This demonstrates the power of blending human expertise with AI efficiency.

The numbers tell a compelling story of rapid growth and tangible benefits in the financial sector.

Adoption rates are soaring, with projections indicating that 90% of finance functions will deploy AI-enabled solutions by 2026.

Investment trends are equally impressive, with $67 billion projected for AI in financial services by 2028.

This influx is expected to contribute up to $340 billion annually to global bank profits through productivity gains.

AI is reshaping core financial operations, from loan processing to fraud detection, with unprecedented speed and accuracy.

In loan underwriting, AI systems compress timelines from days to minutes by evaluating hundreds of data points beyond traditional credit scores.

Holistically evaluate specialized situations in lending, such as agricultural or business cases that don't fit conventional boxes.

For fraud detection, quantum-enhanced AI improves accuracy by 25-40% and reduces false positives by 60%, making financial systems safer.

Agentic AI agents are evolving to handle real customer requests, performing transactions and managing workflows autonomously.

Hyper-personalized banking uses AI to predict customer needs weeks in advance and adjust strategies based on life events.

Voice-enabled support systems deflect calls and resolve issues conversationally, enhancing customer experience.

The sophistication of AI personalization lies in processing multiple data streams simultaneously, from transaction patterns to economic indicators.

This creates a holistic view enabling unprecedented personalization accuracy and customer engagement increases of up to 200%.

Unlike earlier AI focused on cost reduction, 2026 marks a transition to revenue growth and market share gains.

Frontier Firms are transforming support functions into revenue generators through differentiated customer experiences.

Trust in AI is becoming quantifiable, with a shift from model accuracy to verifiable transparency in every decision.

Adaptive compliance systems automatically monitor transactions and generate reports with natural language explanations.

Productivity gains from compliance automation significantly reduce regulatory costs, enhancing operational efficiency.

Organizations are investing in AI to maintain compliance across jurisdictions, building stronger regulator relationships.

This focus on governance ensures that AI augments decision-making without compromising ethical standards.

Private equity firms are increasingly valuing AI integration in their portfolio companies, driving further adoption.

97% of PE firms find it attractive if a company has a successful AI strategy, highlighting its importance in acquisitions.

This trend underscores AI's role as a key differentiator in financial markets, with investments poised to boost global economic growth.

This year marks the transition from AI pilot projects to production-scale deployment across the banking industry.

2026 is positioned as The Year AI Becomes Operational Infrastructure, re-architecting core business processes.

Key success factors include anchoring innovation to business outcomes like safer payments and faster credit decisions.

This shift enables organizations to move from experimentation to fundamental re-architecture, where human-led and AI-operated workflows converge.

As we embrace this augmented future, practical steps are essential for successful implementation.

Start by identifying areas where AI can enhance human judgment, such as in complex lending or compliance monitoring.

Invest in training teams to collaborate with AI systems, ensuring they focus on strategic decision-making.

Measure outcomes regularly to demonstrate value and build trust in AI-driven processes.

By viewing AI as a co-pilot, financial institutions can navigate challenges with agility, driving innovation and customer satisfaction forward.

References