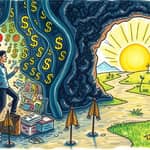

Every day, we navigate a sea of financial decisions, from saving for retirement to managing daily expenses, and too often, our own minds become our worst enemies.

Behavioral nudges provide a compassionate solution by implementing subtle changes in choice architecture that steer us toward better outcomes without stripping away our freedom.

Rooted in the pioneering work of Richard Thaler and Cass Sunstein, these nudges leverage cognitive biases and heuristics to help us conquer common money management pitfalls.

Imagine a life where saving feels effortless, and wise investments become second nature.

That is the transformative power of behavioral nudges, and in this article, we will explore how they can revolutionize your financial journey.

We will delve into practical strategies, real-world examples, and ethical considerations to empower you with knowledge.

By the end, you will have tools to nudge yourself toward financial security and peace of mind.

At their essence, behavioral nudges are interventions designed to predictably influence behavior while preserving autonomy.

They do not force or mandate; instead, they gently guide by altering how choices are presented.

For instance, placing healthier food at eye level in cafeterias can boost selection by over 25%, as research shows.

In finance, nudges can enhance savings rates or refine investment decisions by aligning with our natural tendencies.

This approach springs from behavioral economics, which questions the traditional view of humans as perfectly rational actors.

It acknowledges that emotions, social influences, and mental shortcuts often drive our decisions.

Here are key benefits of incorporating nudges into your financial life:

By embracing nudges, you can move from financial stress to confidence, one gentle push at a time.

To harness nudges effectively, we must first recognize the psychological biases that frequently lead us astray.

These biases explain why traditional financial advice often falls short, and why nudges are so impactful.

Understanding these biases is the first step toward mitigating their effects through thoughtful nudges.

Nudges come in various forms, each crafted to counter specific biases and enhance financial well-being.

Below is a table that summarizes key nudge types and their real-world impacts in finance:

These nudges are not merely theoretical; they are actively used in financial apps, policies, and personal finance strategies worldwide.

For instance, the "Save More Tomorrow" program ties savings increases to future pay raises, effectively countering present bias.

Such approaches demonstrate how small adjustments can yield significant results in financial health.

When applying nudges, it is crucial to do so ethically and effectively to ensure they serve your best interests.

Here are some guiding principles to keep in mind:

By adhering to these principles, nudges can become a force for positive, sustainable change in your financial life.

They help bridge the gap between intention and action, making it easier to achieve your goals.

You do not need to be an expert to start using behavioral nudges; simple steps can make a profound difference.

Here are practical actions you can implement today to nudge yourself toward better financial habits:

These small, consistent changes can lead to substantial improvements in your financial health over time.

They empower you to take control, one nudge at a time, fostering a sense of accomplishment and security.

Beyond personal finance, nudges are shaping broader societal structures and institutional policies.

Governments and companies leverage them to boost participation in retirement plans, improve consumer protection, and enhance financial inclusion.

For example, default enrollment in employer-sponsored savings plans has dramatically increased retirement preparedness among employees.

This demonstrates how nudges can scale to benefit entire populations, making financial systems more effective and equitable.

Key historical milestones in nudge theory include:

These developments highlight the growing recognition of nudges as a tool for social good, transcending individual applications.

While powerful, nudges are not a panacea; they come with potential drawbacks that require careful attention.

Poor design can inadvertently lock people into suboptimal options or foster overconfidence in financial decisions.

It is essential to ensure transparency and avoid manipulation for profit, distinguishing nudges from coercive "shoves."

Common pitfalls to avoid when using nudges include:

By being mindful of these aspects, we can harness nudges responsibly, ensuring they empower rather than undermine.

They should complement, not replace, critical thinking and financial literacy, fostering a balanced approach to money management.

Behavioral nudges offer a compassionate and practical pathway to navigate the complexities of financial life.

By understanding our inherent biases and gently guiding our choices, we can build healthier financial habits and secure a more prosperous future.

Start small, experiment with nudges tailored to your needs, and observe as your financial decisions become wiser and more intentional.

Remember, the goal is not to control but to empower—to nudge yourself toward the life you truly deserve, filled with financial stability and peace.

Take the first step today, and let these subtle guides illuminate your path to financial freedom.

References