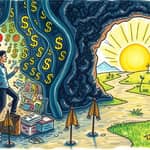

In today's fast-paced world, financial self-care is emerging as a crucial pillar of overall well-being. Proactive practices like budgeting and saving are not just about money; they are about health and happiness.

Stress from finances affects millions globally, with money often cited as the top source of anxiety. 65% of women and 52% of men report it as their primary concern, highlighting a widespread issue.

By integrating financial care into daily routines, individuals can transform their economic health. This approach reduces anxiety and boosts control, paving the way for a more stable and fulfilling life.

Financial self-care extends traditional self-care by directly addressing money as a key stressor. It empowers people to take charge of their financial future through informed actions and mindful habits.

The connection between money and well-being is undeniable, with studies showing that financial security enhances quality of life. Embracing this concept can lead to profound personal and societal benefits.

Financial self-care offers profound benefits that extend far beyond mere monetary gain. It enhances health-related quality of life by providing faster access to essential resources and reducing daily stressors.

For instance, increased income is closely linked to lower risks of mental health issues. An extra $5,000 annually can reduce depression and anxiety risks by about 8%, according to research.

Economically, financial self-care saves billions in healthcare costs worldwide. In the USA, self-care practices save $146 billion through reduced clinical visits and pharmaceutical expenses alone.

These savings translate to better resource allocation and improved public health systems. Individuals benefit from less financial strain and more opportunities for personal growth.

These benefits aggregate to create societal gains, making financial self-care a holistic approach to well-being. By nurturing economic health, we build stronger communities and a more resilient economy.

To harness these benefits, implementing key strategies is essential for lasting change. Financial literacy is the foundation of all successful money management, enabling informed decisions and reducing unnecessary risks.

Mental budgeting, or the practice of tracking expenses mentally, significantly improves self-efficacy. This practice motivates better management and reduces overspending, especially with credit cards.

Self-control in financial matters aligns spending with long-term goals, leading to wiser investments. Higher self-control improves outcomes even during crises like economic downturns or pandemics.

These strategies work synergistically to build a robust financial foundation. They empower individuals to navigate uncertainties with confidence and clarity.

Adopting these approaches fosters a sense of empowerment and security. Over time, they become ingrained habits that support a prosperous future.

Research consistently validates the immense value of financial self-care in modern life. Studies show that investment decision-making mediates well-being, emphasizing the need for comprehensive and holistic financial plans.

Employer-sponsored programs have demonstrated high uptake and effectiveness. This engagement boosts savings rates and reduces stress among employees, leading to higher workplace satisfaction.

The evidence spans various demographics and economic conditions, showing resilience. Financial self-care practices have positive impacts during recessions and global challenges, proving their adaptability.

This data underscores the tangible and far-reaching impacts of adopting financial self-care practices. It reinforces the importance of evidence-based approaches in personal finance.

Beginning your financial self-care journey is more accessible than it may seem. Start with a weekly budget to track income and expenses clearly, providing a baseline for improvement.

Building an emergency fund is crucial for financial resilience. Aim for three to six months of living expenses in a dedicated savings account to cushion against unexpected costs.

Educating yourself on basic investment principles can unlock future opportunities. Knowledge empowers you to make smarter choices and grow your wealth sustainably over time.

Consistency in these actions leads to gradual but significant improvements. Small daily habits accumulate into substantial long-term gains and peace of mind.

These steps provide a clear roadmap for anyone looking to enhance their economic well-being. They are designed to be actionable and sustainable, fostering lifelong financial health.

Financial self-care is not an isolated endeavor; it integrates seamlessly with overall health and happiness. By reducing money stress, you free up mental energy for relationships, hobbies, and personal growth.

This holistic approach benefits society at large by reducing healthcare burdens and promoting economic stability. Individual gains translate into collective economic stability, creating a ripple effect of positive change.

As younger generations increasingly weave finances into wellness routines, the future holds promise for more balanced lives. Adopting these practices early ensures a secure and healthy life, setting a foundation for prosperity.

Embrace financial self-care as a lifelong journey towards prosperity, peace, and fulfillment. It is a powerful tool for nurturing not just your wallet, but your entire well-being.

References