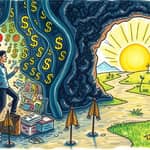

Picture a life where money no longer feels like a source of constant worry, but a tool for fulfillment and security.

This is the promise of financial serenity, a state achieved through a mindful approach to finances that blends awareness with emotional balance.

With 64% of workers reporting financial stress, the need for change has never been more urgent.

By integrating mindfulness practices, we can break free from anxiety and build a healthier relationship with money.

Financial stress is not just a mental burden; it has profound effects on overall well-being.

Studies show that financial stress doubles the likelihood of reporting poor health.

It can lead to increased risks of depression and anxiety, affecting daily life and productivity.

For many, this stress stems from a lack of control over spending, debt, or savings.

Embracing mindfulness helps address these issues head-on.

This shift begins with understanding the deep connection between mind and money.

Mindfulness, rooted in practices of attention and acceptance, has been scientifically linked to better financial outcomes.

Research indicates that mindfulness improves cognitive flexibility and reduces biases like the sunk cost fallacy.

It fosters emotional regulation in financial planning, allowing for more rational choices.

A key component is financial awareness, which involves knowing your assets and debts without judgment.

This awareness is measured through scales with items that track acceptance and engagement.

Critiques exist, such as short sessions potentially favoring present spending, but long-term practice yields positive results.

The benefits of financial mindfulness are measurable and far-reaching, impacting both individuals and organizations.

On a personal level, it leads to higher credit scores and more confident money management.

Psychologically, it reduces anxiety and boosts self-esteem, creating a sense of safety.

Behaviorally, it encourages habits like regular budgeting and resisting impulsive purchases.

For employers, financial wellness programs offer significant returns on investment.

These statistics highlight the transformative power of mindful financial practices.

By focusing on these benefits, we can see how mindfulness translates into real-world success.

Building financial serenity starts with daily habits that foster awareness and control.

Begin by tracking your income, spending, and savings regularly to understand your financial flow.

Reflect on emotional triggers that lead to impulsive purchases or avoidance.

Use budgeting as a tool for values-alignment, not restriction, to find peace in spending.

Incorporate a regular "money practice" into your routine, such as weekly reviews.

These steps help transform stress into proactive engagement.

Over time, this builds a foundation for lasting financial wellness.

Employers play a crucial role in promoting financial serenity through targeted programs and support.

With 90% of workers reporting that mindset impacts their finances, workplace initiatives are vital.

Programs like emergency savings accounts and financial coaching are increasingly popular.

SECURE 2.0 legislation has encouraged more employers to offer these benefits.

This leads to measurable improvements in employee health and productivity.

Future trends suggest rising adoption, especially amid economic uncertainties.

By investing in employee financial wellness, companies foster a more engaged and stable workforce.

Achieving financial serenity is a journey that combines mindfulness with actionable steps.

Start by embracing a mindful money mindset for daily peace and long-term security.

Use the practices outlined here to build awareness, acceptance, and proactive habits.

Remember that small, consistent efforts lead to significant changes over time.

With tools like tracking and budgeting, you can align your finances with your values.

Leverage workplace resources if available, or seek out community support for guidance.

Ultimately, financial serenity is not about wealth alone, but about confidence and well-being.

Take the first step today toward a future where money supports, rather than stresses, your life.

References