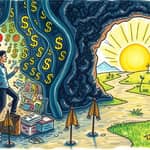

In today's fast-paced world, managing finances often feels like a relentless storm of stress and uncertainty.

Financial Zen is not about wealth accumulation but about cultivating a mindset of inner peace and control over your money.

This philosophy transforms how you approach financial decisions, promoting calm and long-term success through patient, value-aligned actions.

By embracing this approach, you can reduce anxiety and build a healthier relationship with your finances, leading to a more fulfilling life.

At its core, Financial Zen is a state of mental peace achieved through mindful financial management.

It involves embracing patience and strategic inaction, especially during market volatility, to avoid impulsive decisions driven by fear or greed.

Aligning spending with personal values ensures that money serves your life goals rather than controlling you.

Key elements include emotional intelligence to manage impulses, mindfulness for deliberate choices, and discipline to stick to plans amid uncertainty.

This holistic approach fosters resilience and reduces the emotional toll of financial pressures.

To embody Financial Zen, start with these foundational principles:

These practices help create a buffer against external stressors, empowering you to navigate financial challenges with clarity.

Adopting Financial Zen leads to significant reductions in stress and anxiety, improving overall mental well-being.

Studies show that advised investors experience half the high financial stress levels compared to self-directed ones, highlighting the value of guided patience.

With human advisors, 88% of clients report increased peace of mind, demonstrating how support enhances emotional stability.

Emotional improvements are profound, with 71% of human-advised clients feeling more confident and secure in their financial futures.

Mindfulness practices enhance awareness of cognitive biases, supporting more thoughtful and less reactive choices in money matters.

Overcoming barriers like FOMO (Fear of Missing Out) is crucial for long-term financial health and peace.

The benefits extend beyond numbers into daily life:

These rewards underscore why Financial Zen is more than a strategy—it's a lifestyle change.

Understanding the scale of financial stress underscores the urgent need for Financial Zen practices.

These statistics reveal how widespread money-related anxiety is and the potential for transformative change.

These numbers highlight the pervasive impact of financial stress and the hope that mindful practices can bring.

Implementing Financial Zen requires actionable steps that blend patience with proactive planning for real-world impact.

Start by building an emergency fund of 3-6 months expenses in a high-yield savings account to create immediate peace of mind.

This safety net reduces anxiety about unexpected costs and provides a financial buffer during tough times.

Next, focus on aligning spending with your core values through regular reflection and mindful budgeting.

Cut expenses that don't bring joy to fund what truly matters, such as family time or personal growth investments.

Mindfulness can be integrated into daily routines, with budgeting becoming a form of self-care that strengthens your financial foundation.

Studies show that 41% see the biggest improvement in their money relationship from sticking to budgets consistently.

Communication about money with partners or family can alleviate hidden stresses and foster a supportive environment for financial goals.

Celebrate small wins, like paying off debt or consistently investing, to maintain motivation and reinforce positive habits.

Education is key, with 55% of adults believing more financial knowledge reduces stress and empowers better decision-making.

Seek concrete plans and professional advice when needed to navigate complexities and stay on track with your goals.

To embed Financial Zen into your life, adopt these essential habits:

Another effective strategy is debt management through mindful approaches that prioritize well-being.

These strategies empower you to take control and find calm in your financial journey.

Financial Zen extends beyond personal finance to influence overall wellness, productivity, and societal health in meaningful ways.

Integrating financial wellness into self-care routines can reduce mental and physical stress, akin to the benefits of diet and exercise.

It's not about being rich but about having control, which enhances quality of life profoundly and fosters long-term happiness.

In the workplace, financially stressed employees are five times more distracted, costing employers thousands per year in lost productivity.

By reducing financial stress, companies can improve employee engagement, reduce absenteeism, and create a more positive work environment.

Generational trends show younger adults prioritizing financial wellness, with 58% integrating it into their routines for better life outcomes.

This movement emphasizes time freedom over traditional work structures, aiming for decades of purposeful living and personal fulfillment.

Holistic balance is essential; avoid over-focusing on finances to maintain joy in other life areas and prevent burnout.

The ripple effects of Financial Zen include significant societal benefits:

These impacts show that Financial Zen is a powerful tool for personal and collective transformation.

Financial Zen is a transformative approach that can reshape your relationship with money and bring lasting peace.

By cultivating patience, aligning actions with values, and embracing mindfulness, you can find calm in the midst of financial challenges.

Start small with practical steps, celebrate progress along the way, and remember that the journey toward financial peace is as important as the destination.

With dedication to these strategies and a supportive mindset, achieving financial Zen is within reach for everyone, regardless of income or background.

Embrace this path to reduce stress, enhance well-being, and build a future where money serves your life, not the other way around.

References