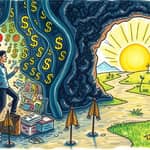

In the ever-evolving landscape of global finance, the year 2026 looms with challenges that demand a proactive approach to investment.

Markets are shaped by inflation persistence and elevated volatility, making traditional strategies insufficient for long-term success.

This article provides a roadmap to build portfolios that not only survive but thrive amid uncertainty, empowering you with actionable insights.

Economic conditions in 2026 are marked by above-trend growth and easing monetary policy, such as Fed cuts of approximately 100 basis points.

However, this comes with higher inflation and moderating equity returns, creating a complex environment for investors.

Elevated index concentration in US mega-caps adds to the risk, highlighting the need for diversification beyond conventional approaches.

Key drivers include geopolitical risks and structural changes like deglobalization, which can disrupt traditional investment patterns.

To adapt, focus on economic indicators and policy shifts that impact asset performance.

This foundation sets the stage for innovative portfolio construction that embraces change rather than fears it.

The classic 60/40 stock-bond mix is no longer a panacea for portfolio resilience in today's markets.

Over time, portfolios can drift, such as from 60/40 to 80% stocks after a decade, exposing investors to undue risk.

Diversification beyond traditional assets is crucial, incorporating alpha generation and uncorrelated returns to buffer against downturns.

This involves a shift towards more dynamic strategies that can navigate inefficiencies and provide downside protection.

By broadening your investment horizon, you create a more resilient financial future.

Hedge funds and alternative assets offer a powerful tool for navigating market turbulence with uncorrelated returns.

Strategies like multi-strategy and equity long/short funds provide alpha and drawdown reduction, ideal amid inflation and high valuations.

Allocating approximately 6% to alternatives, such as TIPS or commodities, can enhance portfolio stability without sacrificing growth.

Tail-risk hedging enables higher equity exposure by adding convexity, allowing you to take selective risks with confidence.

These approaches transform volatility from a threat into an opportunity for strategic gains.

Fixed income strategies must evolve to capitalize on rate cuts and provide reliable income in uncertain times.

Shift towards active ETFs in areas like high yield and EM debt, where global AUM has grown at a 46% CAGR since 2020.

Derivative-income ETFs surged with $47B inflows in early 2025, offering predictable equity income via options for stability.

Focus on shorter maturities of 5-7 years to benefit from anticipated rate cuts, while using high-quality fixed income as rates decline.

This ensures your portfolio remains income-generating even as market dynamics shift.

Equities require a nuanced approach to counter concentration risks and leverage opportunities in a volatile world.

Alpha-enhanced equity strategies track benchmarks with 50-200 bps tracking error, offering consistent alpha at lower costs than active management.

Boost international stocks and value sectors to reduce US mega-cap tilt, tapping into undervalued areas like small-caps.

Selective AI exposure with broader fundamentals can drive growth, while credit-sensitive sectors benefit from easing policy and fiscal support.

By refining equity allocations, you can capture growth while mitigating downside exposure.

Real assets provide a hedge against inflation and geopolitical risks, offering tangible stability in portfolio construction.

A diversified real estate portfolio, for example, might include 40% residential for steady income and 35% commercial for growth.

Geographic spread reduces localized risks, with allocations to REITs and niche assets for liquidity and upside potential.

Precious metals and crypto can add diversification, though specific allocations should align with individual risk tolerance and goals.

This table summarizes core strategies, helping you visualize and implement a resilient portfolio framework.

Implementing these strategies requires careful planning and ongoing management to navigate risks like volatility and policy uncertainty.

Align exposures to your financial goals and time horizons, using tools like optimal cash holdings and tax enhancements.

Targeted construction with alpha and income streams ensures a balanced approach that adapts to market shifts.

Manager selection and public-private balance are critical for executing complex strategies effectively.

By staying agile and informed, you can build a portfolio that withstands the tests of time and turbulence.

Data-driven insights reinforce the importance of innovative strategies, such as the 46% CAGR in active ETF AUM since 2020.

Expert quotes highlight key themes, like the fit of hedge funds for today's market due to inflation and valuations.

Above-trend growth favors selective risk-taking, as noted by financial analysts, encouraging a proactive stance.

Quantitative points, such as derivative-income ETF inflows, provide concrete evidence for adopting new income strategies.

This blend of data and wisdom empowers you to make informed, confident decisions in a volatile world.

Future-proofing your portfolio is not about avoiding risk, but about strategically embracing it to build resilience and growth.

By diversifying beyond traditional assets and incorporating alternative strategies, you can navigate the complexities of 2026 with confidence.

Innovative diversification and proactive management are the keys to turning volatility into opportunity for long-term wealth.

Start today by assessing your current allocations and integrating these insights to create a portfolio that thrives amid change.

Remember, resilience is built through continuous learning and adaptation, ensuring your financial future remains bright and secure.

References