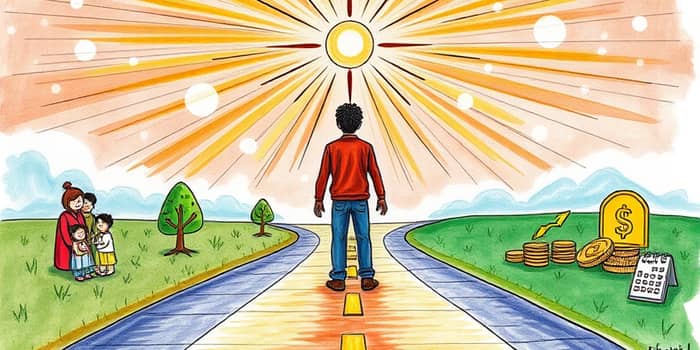

Aligning your finances with your deepest values transforms money from a source of stress into a catalyst for fulfillment. By treating each dollar as a reflection of your priorities, you gain clarity and purpose in every financial decision. Whether you are an individual seeking stability or a business pursuing growth, financial alignment offers a roadmap to sustainable success.

At its core, financial alignment is more than budgeting—it’s about synchronizing financial actions with life priorities and overarching goals. This process involves examining your resources, strategies, and objectives to ensure they resonate with what matters most.

Individuals often pursue financial alignment to support long-term dreams—like home ownership, retirement security, or enriching experiences. Businesses, meanwhile, align budgets and investments to drive strategic objectives such as innovation, market expansion, and social responsibility.

When you link your financial habits to your core beliefs, every transaction carries purpose. For individuals, this means setting aside funds for meaningful pursuits. For organizations, it translates into deploying capital where it fuels strategic impact.

Financial alignment spans several critical dimensions:

Income & Expenses: Map your cash flow to daily needs and higher-order goals, ensuring spending serves purpose.

Goal Setting: Define clear short-term targets (monthly savings, debt reduction) and long-term ambitions (retirement, business scaling).

Budgeting: Transform values into actionable plans. Allocate funds according to priority rather than impulse.

Investments & Asset Allocation: Choose instruments that reflect your risk tolerance and timeline—liquidity for emergencies, growth assets for retirement.

Liquidity & Tax Strategy: Optimize structures to balance accessible funds with efficient tax planning in changing environments.

Monitoring & Adjustment: Conduct regular reviews to pivot when life or market conditions shift.

Accountability & Engagement: Cultivate personal discipline or organizational buy-in through transparent goals and shared metrics.

Turning theory into practice requires deliberate steps. Begin by assessing where your finances diverge from your ambitions.

Misaligned finances can lead to unintentional risk exposure, wasted resources, and missed opportunities. Individuals may overextend credit or neglect essential savings. Businesses risk inefficient capital deployment, internal friction, and vulnerability to market downturns when budgets don’t support core initiatives.

When your wallet aligns with your values, you unlock multiple advantages. Individuals enjoy greater stability, reduced stress, and higher confidence in achieving life goals. Businesses benefit from financial resilience, organizational unity, streamlined operations, and sustainable growth. Across the board, aligned finances increase the probability of realizing meaningful objectives.

Quantitative metrics help track the impact of alignment efforts. Below is a snapshot of sample indicators for individuals and businesses:

Regularly review these metrics to ensure you remain on track. Adjust contributions, re-balance portfolios, or reassign resources based on evolving priorities.

Who benefits from financial alignment? Anyone—individuals, families, and organizations—with defined financial goals can gain clarity and purpose from this approach.

How do I start? Begin by articulating your core values, then map your income and expenses against those priorities. Establish goals and implement routine check-ins.

What challenges might arise? Life events, market volatility, and unclear objectives can disrupt alignment. Stay flexible and revisit your plan when circumstances change.

The art of financial alignment lies in continuous, conscious synchronization of money with what matters. By weaving your values into every budgeting, saving, and investing decision, you transform your finances from a source of anxiety into a powerful tool for progress. Embrace this journey, and watch your wallet become a mirror of your aspirations.

References