Every budget tells a story, not just of income and expenses, but of identity and personal values and priorities. This simple truth reveals how our spending habits act as a powerful lens into our inner world.

Money is far more than a transactional tool; it serves as a reflective mirror that can uncover our deepest fears, beliefs, and emotional states. By examining where our money flows, we gain insights that go beyond mere numbers.

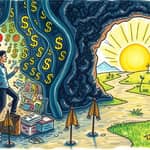

The concept of the financial mirror invites us to shift our perspective from restriction to self-discovery. It transforms budgeting from a chore into a journey of intentional listening and emotional clarity.

The financial mirror has two distinct sides that work together to reveal our true selves. On one hand, it shows concrete financial statements detailing where our energy and money actually go.

On the other, it presents a metaphorical energetic checkbook that tracks our daily activities and time investments. This dual approach helps us see patterns that might otherwise remain hidden.

For instance, spending on fast food versus organic groceries can signal deeper values about health or convenience. Similarly, designer clothes versus bulk buys might reflect beliefs about self-worth or social status.

Money plays an emotional and symbolic role that extends far beyond paying bills. It reflects what we prioritize, protect, and invest in, often driven by unseen forces.

Fears like scarcity, rejection, or failure can subtly dictate our spending choices. Purchases made for safety or control might actually stem from a sense of unmet emotional needs.

The soft wealth philosophy emphasizes coherence and wholeness over mere accumulation. It encourages aligning spending with our deepest values rather than reacting to fears.

Asking key questions can turn reactive spending into aligned practices. Inquire what emotions you're trying to feel or what fears might be driving avoidance.

This approach shifts the focus from spreadsheets to emotional clarity and self-discovery. It helps bridge the gap between claimed priorities and actual behaviors.

To effectively use the financial mirror, start by reviewing your financial statements with an objective eye. Act as a detective analyzing patterns without judgment.

Look for disconnects, such as investing in supplements but neglecting healthy groceries. Notice time-saving conveniences that might substitute for unfulfilled wishes or emotional voids.

Next, track your energetic expenditures by logging daily activities from wake to sleep. Assign positive or negative values based on how each activity affects your energy levels.

This method, akin to balancing a checkbook, reveals priorities and potential drains. Compare it to your monetary spending to find overlaps and insights.

Create lists for self-assessment, noting actions that induce pride versus those that lead to self-dislike. Calculate the percentage alignment with your monthly spending to identify areas for growth.

Shift towards more prideful activities to boost your energy earnings and self-worth. This practice fosters a positive cycle of improvement and fulfillment.

For significant purchases, apply the pre-purchase test. Imagine spending a month's salary on the item; if you're unwilling, it may not align with your true values.

Many people fall into quiet traps that keep them in a paycheck-to-paycheck cycle, often contradicting their revealed values. Recognizing these habits is the first step toward change.

Additional patterns include overspending or underspending as fear responses, and denial through vagueness that leads to snowballing financial issues. Awareness is key to breaking these cycles.

The journey with the financial mirror is not a one-time fix but an ongoing practice of curiosity and growth. Regular money dates can help maintain awareness and adaptability.

Vicious cycles often emerge when we believe buying happiness leads to debt, stress, and damaged self-esteem. Interconnected checkbooks show how monetary and energetic balances mirror each other.

Inspirational quotes can emphasize key lessons. For example, financial literacy is about emotional clarity, not just spreadsheets. Or, do not save what is left after spending; spend what is left after saving.

Shifting your financial narrative involves aligning actions with values to create a life of coherence and fulfillment. This process empowers you to move from fear-based reactions to value-driven choices.

Ultimately, the financial mirror invites you to see money as a reflection of your inner world. By embracing this perspective, you can transform your habits, reduce stress, and build a more intentional and prosperous life.

References