In a world of accelerating change, where economic shifts and policy decisions ripple through our lives, a new approach to wealth management emerges.

Intentional foresight in fiscal decisions is not just for governments or corporations; it is a powerful tool for personal prosperity.

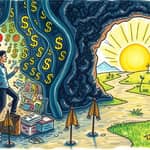

Becoming a fiscal futurist means connecting your present choices to a secure and abundant future, transforming uncertainty into opportunity.

This article will guide you through the mindset and strategies to thrive in the years ahead, blending macroeconomic insights with actionable steps for 2025-2026 and beyond.

Fiscal futurism combines the principles of fiscalism with the forward-thinking nature of futurism.

Fiscalism emphasizes government reliance on fiscal policy for economic stability, rooted in Keynesian theory and Modern Monetary Theory (MMT).

Futurism involves systematic prediction of trends across economics, technology, society, and politics to shape outcomes through current decisions.

Together, they form a proactive framework for personal financial planning that anticipates scenarios like market volatility, inflation, and policy changes.

This mindset shifts you from reactive planning to strategic foresight, ensuring your wealth grows resiliently over time.

Understanding macroeconomic trends is crucial for aligning your financial plans with broader economic forces.

Fiscalism prioritizes government intervention, such as spending and taxation, to drive growth and stability over monetarism.

Key types include contained fiscal policy, which limits economic growth or decline, and elevated policy, which allows growth and prevents decline.

From MMT, learn that taxes control inflation rather than fund spending, and deficits can offset private saving to achieve full employment.

Real resource constraints not debt are the true limits, offering insights for personal planning in times of inflation or recession.

By anticipating fiscal policies, like Germany's focus on transparency and sustainability, you can better navigate economic cycles.

Consider these macroeconomic insights as you plan:

As 2025 approaches its end, now is the time for a comprehensive financial review to set the stage for future success.

Start by conducting a full inventory of your assets, including 401(k)s, pensions, and savings accounts, to assess your overall balance sheet.

Align goals with current financial standing to identify gaps and opportunities for growth.

Tax bracket management is critical; accelerate income or gains if you expect higher future brackets, given that rates are stable until the end of 2025.

Consider strategies like Roth conversions, gain/loss harvesting, and bonus acceleration to optimize your tax position.

Maximize contributions to retirement and health accounts to leverage tax advantages and build wealth efficiently.

Use the table below to reference key contribution limits for 2025:

Gain/loss harvesting involves selling underperforming assets to offset gains, but defer if you anticipate higher future tax brackets.

Key steps for your year-end review include:

Building lasting wealth requires a structured approach that balances short-term tactics with long-term vision.

Set SMART goals: Specific, Measurable, Achievable, Relevant, and Time-bound objectives to guide your financial journey.

Examples include saving for a home by December 2025 or paying off debt by July 2025.

Adopt a budgeting framework like the 50/30/20 rule, allocating 50% to necessities, 30% to wants, and 20% to savings and debt repayment.

Emergency fund of 3-6 months is essential for weathering unexpected expenses; automate transfers to build it consistently.

Portfolio strategy should diversify amid 2025 risks such as tech outperformance, USD strength, and policy changes.

Balance tactical shifts with a long-term allocation to stay resilient in varying market conditions.

Focus on your personal balance sheet by managing assets and liabilities in both falling and rising rate environments.

Holistic planning involves inventorying all assets, closing gaps in areas like estate planning, and using scenario modeling with advisors.

Consider these elements for effective wealth planning:

Proactively managing risks ensures your financial plan remains robust in the face of uncertainty.

Reassess risks and benefits regularly, especially for health accounts and insurance coverage.

From MMT, the employer of last resort (ELR) concept emphasizes employment stability, which can inform your career and income strategies.

Inflation and uncertainty tactics include prioritizing needs over wants and integrating personal values into financial plans.

Embrace futurist principles by imagining multiple futures, using qualitative and quantitative methods, and questioning assumptions.

Prepare for 2026 by reviewing charitable giving, cash flows, and investments for tax efficiency and alignment with goals.

Key risk management strategies to implement:

Transforming into a fiscal futurist requires immediate actions and a shift in mindset toward proactive planning.

Start with immediate to-dos, such as maximizing December deadlines for contributions and FSAs, and consulting advisors for personalized scenario analysis.

Establish ongoing habits like annual financial reviews, auto-escalation of savings, and applying systems thinking to understand interconnections, such as how fiscal policy impacts personal tax rates.

Map present choices to prosperous tomorrows by consistently aligning decisions with long-term visions.

This call to action invites you to embrace fiscal futurism, turning foresight into tangible wealth and security.

Remember, financial planning is not just about numbers; it's about crafting a future that reflects your aspirations and values.

Take these steps to begin your journey:

By integrating these strategies, you can navigate the complexities of the modern economy with confidence and clarity.

Your prosperous tomorrow starts with the choices you make today, empowered by the vision of a fiscal futurist.

References