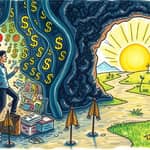

In today's fast-paced world, financial stress often feels overwhelming, but a new approach offers hope.

Financial mindfulness is the practice of engaging with money through awareness, acceptance, and proactive action.

Research from Georgetown's McDonough School of Business, based on a survey of 2,000 consumers, shows this method can transform lives.

Financial stress and mental health are deeply intertwined in a vicious cycle.

Debt or unexpected expenses can trigger irritability, sleep problems, and even physical symptoms like back pain.

Conversely, poor mental health reduces productivity and income, worsening financial situations.

This bidirectional impact affects many, with 57% of employees citing money as their top stress source.

Understanding this cycle is the first step toward breaking it.

At its heart, financial mindfulness involves three key practices that anyone can adopt.

First, awareness means reviewing financial statements calmly without judgment.

Second, acceptance involves confronting realities, such as debts, without emotional reactivity.

Third, proactivity helps avoid decision traps like the sunk cost fallacy.

These practices foster rational choices and reduce financial avoidance.

Mindfulness-based interventions (MBIs) provide strong evidence for the benefits of this approach.

A systematic review of 28 economic evaluations shows MBIs are generally cost-effective or cost-saving.

This is especially true for short-term interventions, making them scalable and adaptable.

These findings highlight how MBIs can lead to improved psychological well-being and financial stability.

Employers are increasingly recognizing the value of financial mindfulness in the workplace.

Surveys show that 83% of employers report that financial wellbeing initiatives positively impact employees.

Common offerings include mental health coverage, employee assistance programs (EAPs), and mindfulness apps.

By integrating such programs, workplaces can foster a healthier, more productive environment.

Implementing financial mindfulness doesn't require wealth; it starts with small, consistent actions.

Financial strategies include budget assessment and setting short-term goals.

Non-financial strategies, such as mindfulness exercises, complement these efforts.

This holistic approach ensures that both mind and money are cared for.

Financial mindfulness is accessible to everyone, regardless of income or background.

It can be cultivated through simple tips, like regular reflection on spending habits.

Wealthier individuals may still struggle, while others build resilience out of necessity.

This inclusivity makes it a powerful tool for diverse populations.

The wellness market in the U.S. alone exceeds $500 billion annually, reflecting a growing consumer priority.

Financial mindfulness fits into this trend as a holistic approach that grounds buzzwords in empirical data.

It counters overuse by emphasizing practical, evidence-based methods.

This alignment with broader wellness movements ensures its relevance and sustainability.

To embark on this path, start by incorporating one mindful practice into your daily routine.

Future research should explore applications in low-resource settings to broaden impact.

Remember, the journey to financial wellbeing is ongoing and rewarding.

By taking these steps, you can transform stress into stability and thrive.

References