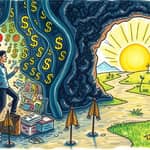

The financial landscape of 2026 beckons with unprecedented opportunities, inviting investors to venture beyond traditional markets.

As we stand on the brink of a new era, driven by technological leaps and evolving economic dynamics, the call to explore uncharted investment territories becomes more compelling than ever.

This guide aims to illuminate the path forward, offering a detailed roadmap for those ready to embrace the future.

With insights from major financial institutions, we delve into the themes shaping the next wave of wealth creation.

From AI dominance to infrastructure revolutions, the potential for growth and innovation is vast and thrilling.

At the heart of the 2026 investment outlook lies a convergence of technology, productivity, and income strategies.

U.S. tech and AI continue to dominate, representing growth-oriented investments that cannot be ignored.

However, the key is balancing this with defensive approaches, ensuring resilience in volatile markets.

Productivity dynamics are shifting, with above-trend growth, easing policy, and accelerating productivity defining the economic backdrop.

This environment reshapes how we think about income, moving away from reliance on single sources.

Instead, a diversified income portfolio sourced across various assets is now essential for stability and growth.

The frontiers of investment are expanding into sectors once considered niche or overlooked.

Infrastructure and real assets emerge as a major frontier, with compelling sub-sectors driving demand.

Data centers are positioned as the most compelling infrastructure opportunity.

Driven by surging energy demand and expanding cloud computing needs, they offer robust growth potential.

Energy infrastructure focuses on modern, efficient systems, particularly gas-powered generation and utilities.

Clean energy and storage also present significant opportunities, especially in private markets.

Electric utilities trading at discounts with accelerating earnings are attractive investments.

In real estate, several niches show strong supply/demand characteristics.

Real estate debt continues to offer attractive valuations and wide spread premiums, though sentiment is shifting toward equity.

A barbell approach in equities balances growth-oriented U.S. tech/AI with defensive positioning.

This includes dividend growers and listed infrastructure, providing income and lower volatility.

U.S. large caps are preferred over small caps due to dominance in tech and favorable policies.

Emerging markets remain vulnerable to trade policy risks, requiring caution.

Private equity markets are seeing growing positive positioning as opportunities expand.

In alternative investments, farmland stands out for its differentiated return potential and inflation-hedging.

However, price moderation in row crop margins, especially in the U.S., introduces headwinds.

Several factors are shaping the investment landscape, creating both opportunities and challenges.

These drivers underscore the importance of adapting to evolving market conditions for success.

Building a resilient portfolio in 2026 requires updated methodologies and a focus on diversification.

Embracing these principles can help navigate the complexities of uncharted investment territories effectively.

While opportunities abound, it's crucial to remain aware of potential pitfalls.

By acknowledging these risks, investors can make more informed and strategic decisions.

This table summarizes the diverse landscape, highlighting where to focus and what to watch.

As we look ahead, the journey into new investment frontiers is both exciting and demanding.

With careful planning and a willingness to explore, the rewards can be substantial and transformative.

References