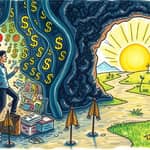

In a world where trust is often elusive, a revolutionary shift is underway, transforming how we perceive and exchange value.

The Trust Economy is defined as a system where trust becomes the central currency, enabling seamless transactions without traditional intermediaries.

This new paradigm is powered by decentralized technologies like blockchain, which reimagine finance by replacing human oversight with mathematical certainty.

At its core, blockchain introduces a trustless system based on code, transparency, and immutability, moving away from reliance on institutions or personal relationships.

The journey began with Bitcoin in 2008, which pioneered the concept of a decentralized, peer-to-peer financial network.

This invention marked a departure from centralized control, laying the foundation for a new era of digital trust.

Blockchain evolved from this, offering a shared, immutable digital ledger that records transactions in a tamper-proof manner.

It ensures data integrity and security, allowing participants to verify information without third-party dependence.

Blockchain fosters trust through several critical mechanisms that enhance reliability and efficiency in finance.

Transparency provides a single source of truth for all network participants, reducing ambiguity and fostering mutual standards.

Trust via cryptography replaces interpersonal faith with mathematical proof, significantly lowering risks of fraud and manipulation.

Programmability through smart contracts automates business processes, such as payments or underwriting, boosting operational trust.

Privacy and compliance tools enable granular data sharing and verification, supporting frameworks like KYC and AML in enterprise settings.

The prerequisites for trust in this system include attitudes of trustors, reputations of trustees, and institutional assurances from laws or contracts.

The global cryptocurrency market is experiencing explosive growth, with projections indicating a robust future through 2026.

Revenue is expected to surge from $85.7 billion in 2025 to $95.1 billion in 2026, showcasing increasing adoption and investment.

Key metrics highlight this upward trajectory, from user penetration rates to institutional holdings.

2026 is poised to mark the dawn of the institutional era in cryptocurrency, driven by regulatory shifts and increased investment.

Bipartisan legislation in the US, such as the GENIUS Act passed in 2025, is expected to provide clearer frameworks for crypto operations.

Institutional inflows are becoming persistent, with crypto transitioning into strategic portfolio allocations and sustaining a bull market.

Decentralized finance (DeFi) offers a stark contrast to traditional finance (TradFi), providing open and low-cost alternatives on public blockchains.

It eliminates paperwork and intermediaries, enabling more inclusive and efficient financial services.

Benefits include streamlined processes through real-time data and automation, enhancing accessibility and reducing costs.

Looking ahead to 2026, several trends are set to shape the financial landscape, driven by technological advancements.

Stablecoins are becoming an internet settlement layer, facilitating seamless transactions across digital ecosystems.

Tokenization at scale will revolutionize asset management, making it easier to trade and own fractional shares of real-world items.

AI integration promises to enhance predictive analytics and risk assessment, further embedding trust in automated systems.

Despite the optimism, the Trust Economy faces significant challenges that must be addressed for sustainable growth.

Economic limits exist for trust-at-scale without government oversight or the rule of law, requiring balanced approaches.

Social and cultural contexts play a crucial role in trust production, meaning technology alone cannot solve all issues.

Scalability and interoperability remain hurdles, as blockchain networks need to handle increasing volumes efficiently.

The Trust Economy, powered by blockchain, is not just a fleeting trend but a fundamental reimagining of finance.

By shifting from centralized intermediaries to decentralized networks, it offers a path to greater transparency, security, and inclusivity.

As we move into 2026, sustained growth and convergence with traditional finance seem inevitable, driven by innovation and trust.

This transformation invites us all to participate in building a financial system where trust is earned through code, not just promises.

References