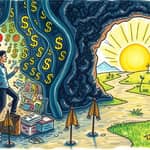

Imagine your financial life as a tapestry, where each decision is a thread weaving into a grand design.

Without intention, these threads can fray and weaken, leaving you vulnerable.

By interlacing your financial decisions, you create a fabric that withstands life's storms.

This metaphor draws from WealthWave's wave imagery, symbolizing momentum in wealth building.

Inspired by demographic shifts, it represents a push toward lasting financial security.

Financial illiteracy plagues many, leading to disjointed efforts and missed opportunities.

Statistics reveal that 62% of people aspire to be their own boss.

Yet, traditional models often hinder scalable growth and shared success.

WealthWave's team-based expansion offers a refreshing alternative.

It empowers individuals to earn the highest contracts through performance.

This shift from linear paths to interconnected models is transformative.

This table illustrates the power of collaborative financial models.

These milestones provide a roadmap for families to achieve financial stability.

Each step interlocks, ensuring no aspect is overlooked in your wealth journey.

Starting with an emergency fund builds a safety net for unforeseen events.

Progressing to debt management and retirement savings secures your future.

Advanced stages include investment growth and estate planning for legacy.

Following these steps weaves a strong financial foundation.

Begin by defining clear short-term and long-term goals aligned with your values.

Time horizon is crucial for tailoring investment strategies effectively.

For instance, prioritize debt repayment while maintaining minimal savings buffers.

This balance prevents financial strain and keeps you on track toward aspirations.

Regularly reassess goals as life evolves, ensuring they remain relevant and motivating.

Debt can be a heavy burden if not managed with strategic methods.

Use approaches like avalanche or snowball to tackle liabilities efficiently.

Automating savings transfers simplifies the process and reduces temptation.

Invest in high-yield accounts and tax-advantaged options like 401(k)s or IRAs.

Diversification across assets and regions minimizes risk and enhances returns.

These actions free up resources for other financial priorities.

Emotional triggers often lead to impulsive and costly financial mistakes.

Implement structured plans to mitigate biases and maintain clarity.

Regular reviews every 6-12 months provide accountability and adjustment opportunities.

Seek second opinions from trusted advisors to gain broader perspectives.

Consistency in process is more valuable than seeking perfection in every decision.

Adopt principles that guide daily choices and reinforce financial discipline.

Needs versus wants analysis helps prioritize essential spending over luxuries.

Create a spending plan that maximizes savings and aligns with goals.

Execute and stick to your plan with unwavering commitment and resilience.

These strategies ensure your financial weave remains resilient and adaptive.

Beyond personal finance, consider leveraging team-based models for expansion.

WealthWave offers four income dimensions that enable scalable growth and shared success.

This framework supports collaborative achievement and financial empowerment.

Develop an abundance mindset to attract wealth through positive actions and goals.

Holistic planning includes family impact and values for comprehensive wealth management.

Protect and enhance your wealth for future generations with estate planning tools.

Interlacing your financial decisions is an ongoing journey of care and intention.

Embrace education and coaching to refine your skills and adapt to changes.

Start today by assessing your current financial fabric and identifying loose threads.

Weave each decision with purpose, and watch your wealth grow into a masterpiece of security and freedom.

Let the Wealth Weave inspire you to take control and build a legacy that lasts.

References