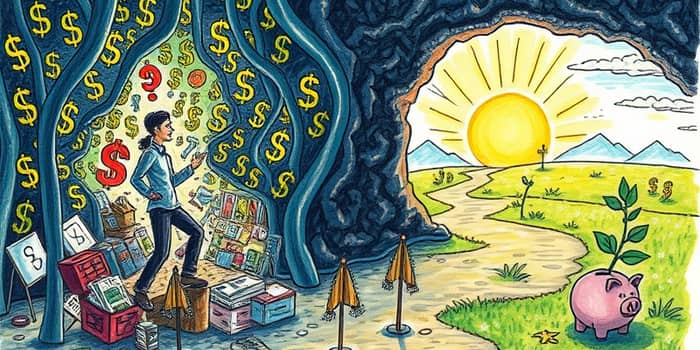

Have you ever wondered why you make certain financial decisions, often against your better judgment? Deeply ingrained, often unconscious beliefs about money, known as money narratives, could be the hidden force driving your actions.

These narratives shape how we spend, save, and invest, influencing our entire financial journey from a young age. Formed primarily in childhood, they become the silent scripts that guide our money habits.

By understanding and rewriting these stories, you can achieve greater financial clarity and empowerment. This article will guide you through the process, offering practical steps to transform your relationship with money.

Money narratives, also called money scripts or money stories, are subconscious beliefs about finances that develop early in life. They act as internal guides, often without our awareness, dictating our financial behaviors.

Research shows that these narratives begin forming around age five and solidify by adolescence. With 95% formed unconsciously, they lead to emotional and sometimes irrational decisions.

The impacts of these narratives are profound. Positive narratives promote security and growth, while negative ones can cause self-sabotage and anxiety.

Behavioral finance emphasizes that mindset is key. Believing wealth is possible increases positive behaviors, whereas pessimism often results in financial inaction.

Emotions heavily influence money decisions. For example, 66% of very stressed people avoid finances, and 39% spend to feel better when anxious or sad.

Financial psychologists Brad Klontz and Ted Klontz identified four main types of money narratives. Each has its own characteristics and potential outcomes.

Understanding which narrative resonates with you is the first step toward change. These categories are not inherently good or bad, but must align with your current goals.

Money narratives develop through various influences, starting in childhood. Family discussions and observations play a crucial role in shaping these beliefs.

Subtle experiences, like a child keeping change as a reward, can embed lasting impressions about money's value.

Societal norms and media often reinforce one-dimensional views, such as "rich equals greedy," which can limit financial potential.

Reflecting on questions like "How was money discussed at home?" can reveal underlying scripts. Unconscious development means many go unexamined, leading to repetitive patterns.

To uncover your money narrative, start with introspection. Journal your family money talks and emotional responses to financial situations.

Ask yourself about past experiences where money triggered strong emotions. This can highlight your dominant narrative.

This process helps separate emotions from actions, providing clarity. Identifying the script is key to rewriting it for better financial health.

Once identified, you can begin rewriting your money narrative. This involves several practical steps to shift your mindset and habits.

Financial mindfulness is crucial here. Non-judgmental acceptance leads to rational choices and better outcomes. Align your new narrative with core values like security or freedom.

For example, if you have a money avoidance narrative, you might start by acknowledging that money can be used for good. Shifting negative stories reduces cognitive load, making decisions easier.

Rewriting your money narrative offers numerous advantages, from improved decisions to enhanced wellbeing.

By transforming your internal story, you can overcome barriers and achieve clarity. Your mindset can be your greatest asset in the journey toward financial freedom.

Embrace the process of change, starting with the belief that it is possible. We can change the story we tell ourselves, paving the way for a brighter financial future.

Consider intergenerational transmission, where money stories are passed down, affecting wealth planning. Breaking these cycles empowers future generations.

Real-life examples, like Sarah who overcame money avoidance, show that transformation is achievable with effort and awareness.

Start today by reflecting on your own money narrative. With each small step, you move closer to financial clarity and a more empowered life.

References