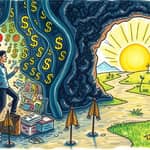

In an era of financial uncertainty, crafting a personal economic blueprint is the key to unlocking stability and success.

This guide will walk you through practical steps to build a resilient financial future, inspired by 2026-focused planning insights that prioritize adaptability and growth.

By embracing a structured approach, you can transform your money habits and achieve lasting prosperity.

Start your journey with a thorough financial assessment to understand your current position.

Conduct a full balance sheet review by listing all assets and liabilities, from savings accounts to credit card debts.

This process reveals your net worth and highlights areas for improvement.

Reflect on the past year to evaluate if your financial goals were met and identify any unexpected expenses.

Regular reviews, perhaps quarterly, help you stay on track and adjust as needed.

This foundational step sets the stage for all future planning, ensuring you have a clear starting point.

Effective goal-setting turns dreams into actionable plans that drive progress.

Adopt SMART goals that are specific, measurable, and realistic, such as saving a fixed amount each month.

Break larger objectives, like retirement or buying a home, into smaller, manageable steps.

Create a dynamic financial plan that evolves with life changes, such as marriage or career shifts.

By setting clear intentions, you build momentum and focus towards achieving your aspirations.

Budgeting is essential for managing daily finances and ensuring long-term security.

Explore popular budgeting rules to find one that suits your lifestyle and financial priorities.

Adjust your budget for salary changes or inflation to maintain flexibility.

Pay yourself first by automating savings contributions, treating them like non-negotiable expenses.

Mastering cash flow empowers you to allocate funds wisely towards your goals.

Managing debt is crucial for freeing up resources for savings and investments.

List all your debts, from mortgages to credit cards, to gain a comprehensive view.

Prioritize paying off high-interest debt first to minimize interest accumulation over time.

Balance debt repayment with saving efforts to avoid falling behind on other financial priorities.

Effective debt management paves the way for greater financial freedom and reduced stress.

Saving for retirement is a long-term commitment that requires consistent effort and strategy.

Aim to maximize contributions to accounts like 401(k)s and IRAs, taking advantage of employer matches.

Target saving at least 15% of your salary, increasing this percentage if you are a high earner.

Bridge the retirement savings gap by educating yourself on tax implications and automated savings tools.

Proactive saving habits ensure you are prepared for a comfortable and independent retirement.

Tax planning can significantly impact your net income and retirement savings over time.

Stay informed about key 2026 tax changes, such as the increased SALT deduction cap and new senior deductions.

Nearly half of Americans undervalue taxes in retirement planning, so prioritize this aspect early.

Strategies like Roth conversions can be effective in low-income years to reduce future tax burdens.

By optimizing taxes, you retain more resources to invest in your goals and dreams.

Investing is key to building wealth and achieving financial independence over the long term.

Focus on resilience and alignment with your goals, staying invested through market volatility.

Adjust your portfolio based on factors like expected rate cuts and inflation trends.

Review investments annually to ensure they support your objectives, from short-term needs to estate planning.

Strategic investing transforms savings into a powerful engine for future prosperity.

Unexpected events can derail even the best-laid financial plans, so preparedness is essential.

Build an emergency fund to cover essentials, as 72% of Americans face unexpected bills that lead to debt.

Update insurance policies and beneficiaries regularly to ensure adequate coverage for life's surprises.

Boost predictable income sources, like Social Security, for retirees to enhance financial stability.

Robust protection measures provide peace of mind and keep your blueprint intact during crises.

Long-term success relies on consistent habits and leveraging available resources for support.

Utilize workplace programs and government aids to offset expenses and enhance your financial toolkit.

Develop annual review rituals, like gathering tax documents early, to stay organized and proactive.

Involve advisors for complex decisions, ensuring your plan remains tailored and effective over time.

By cultivating positive habits, you reinforce your economic blueprint for lifelong resilience and joy.

Designing your economic blueprint is not a one-time task but an ongoing journey of growth and adaptation.

By integrating assessment, planning, and action, you can navigate challenges and seize opportunities with confidence.

Remember, prosperity is built step by step, with each decision shaping a brighter financial future.

Start today, and let your blueprint guide you towards a life of abundance and security.

References