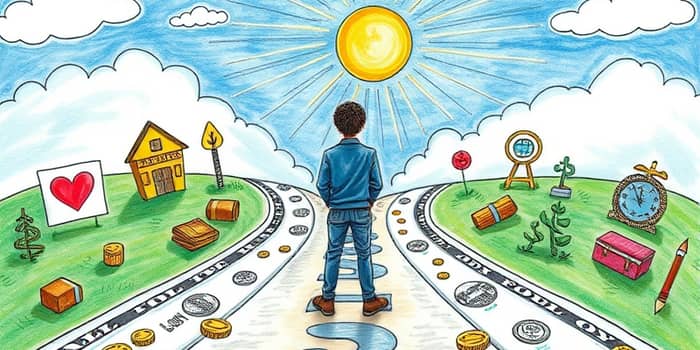

Intentional spending isn’t about spending less—it’s about spending with purpose, turning every dollar into a step toward the life you want. When we pause to consider our purchases, we gift ourselves clarity, confidence, and control over our financial journey.

In a world driven by impulse and persuasion, choosing to spend deliberately transforms money from a source of stress into a powerful tool for well-being. By aligning our wallets with our values, we foster fulfillment instead of fleeting gratification.

At its core, purposeful spending is rooted in behavioral psychology. Advertising, social signals, and emotional triggers often hijack our decision-making, leading to purchases we quickly regret. Transitioning from reactive habits to proactive, mindful financial decisions requires awareness of these influences.

The next time you reach for your card, take a moment: breathe, step back, and ask, “Does this support my long-term objectives?” This simple pause helps break automatic spending loops and fosters a habit of reflection.

Our values—whether they center on family, health, ethics, or personal growth—serve as north stars for financial choices. When spending reflects what matters most, every purchase becomes an investment in our own happiness and the world we wish to create.

Embracing these strategies fosters a sense of financial empowerment and renewed purpose, replacing regret with confidence and excitement for the future.

This table illustrates how diverse categories can transform spending into a reflection of personal priorities. It’s not about depriving yourself—it’s about investing in what truly enriches your life.

Rejecting impulse purchases doesn’t mean isolating yourself from modern life. Instead, it’s about participation on your own terms. By consciously choosing products and services that align with your values, you contribute to a shift toward ethical business practices.

If a company’s values clash with yours—perhaps due to environmental harm or unfair labor—it becomes easier to withhold support and redirect your spending. Over time, collective consumer choices send a powerful message, encouraging businesses to adopt more responsible models.

When you choose local artisans over mass-market retailers, you bolster your community’s economy. Opting for sustainable goods reduces waste and environmental strain. Donating to causes you believe in empowers organizations to drive meaningful change.

Small decisions spark significant change: every dollar becomes a vote for the world you wish to inhabit. Purposeful spending fuels a virtuous cycle—benefiting not just your finances, but the well-being of people and the planet.

Embracing mindful spending yields rewards immediately and far into the future. Here’s how:

These benefits layer upon each other, creating momentum. What begins as a simple habit of pausing before purchases can culminate in lifelong stability and fulfillment.

Ready to transform your financial life? Begin with these steps:

Commit to your first mindful purchase today. Whether it’s a healthy meal, a new book, or a donation to a cause you love, let every spend tell your story. As you align your expenditures with your aspirations, you’ll discover that financial freedom isn’t a distant dream—it’s the natural outcome of living—and spending—with purpose.

References